Transaction Disputes

You have the right to object to transactions made without your knowledge, and that appear suspicious or erroneous in your credit or debit card activity. The procedures and durations of disputes relating to transactions are determined by national and international law with legally binding consequences for banks and all their customers. Under specified conditions, a dispute can be brought before any bank and to any transaction. A dispute is issued by the cardholder by completing the "Transaction Dispute Form" at a branch of the bank or online, and this request is forwarded to the business where the transaction took place. The bank demands details of the disputed transaction from the company. If the requested information is insufficient, and if the cardholder is found to be right, the disputed amount is collected from the company by their bank and transferred to the bank to which the card belongs.

You can dispute transactions made with your Sipay prepaid cards in case of suspicious activities by calling our number 444 67 67 or by filling out the transaction dispute form available on our website.

According to international transaction dispute rules, transaction disputes must be submitted in writing. The dispute process may vary between 30 and 180 days depending on the transaction type and the reason for the dispute. You can submit your transaction disputes through your bank’s branches or by filling out the transaction dispute form available on your bank’s website. If you download the form from the website, you must print it, complete it according to your bank’s guidelines, and then send it to your bank via email. You must submit your dispute to your bank as soon as possible. Additionally, depending on the transaction details and the reason for your dispute, your bank may request supporting information and documents.

For disputes related to transactions made with your Sipay prepaid cards, you can call us at 444 67 67 or fill out the transaction dispute form available on our website.

1. Suspicious Transactions

In cases where the transaction was not made by you or a person authorized by you, you can close your credit card by contacting your bank and then raise a dispute. Disputes in this category won’t be positively evaluated if one of these conditions is met:

- If the transaction was made using a 3D Secure password (if the transaction was made by entering the password in the SMS sent to the number registered in the bank)

- If the transaction was confirmed by mobile verification (if the transaction was confirmed from the mobile banking application of a bank that uses mobile verification)

- If the payment was made without entering the card details in a website or mobile application (if the payment was made through applications like BKM Express)

- If the transaction was made using the card’s password

- If the transaction was made using the chip or the magnetic stripe of the card

2. Transactions made when the card is reported lost or stolen

3. Erroneous transactions

- If the product or service is incomplete or is not provided at all, or if the product or service provided is not as described

- If the amount of the transaction is different from what it should be

- If the amount of the transaction is charged more than once

- In case of cancellation, if you can’t see the required amount or if you see an incorrect amount of money on your card

- When you withdraw cash from ATMs, if the amount given is incomplete or if the transaction appears on your card even if it’s not withdrawn at all

On the sipay.com.tr website, you can only dispute transactions related to your Sipay prepaid card. You can submit your transaction dispute by calling us at 444 67 67 or by filling out the transaction dispute form available on our website.

You have the right to object to transactions made without your knowledge or that appear suspicious or erroneous in your credit or debit card activity.

Transaction disputes related to Sipay Prepaid Cards can be submitted through our call center at 444 67 67 or via email at harcamaitirazi@sipay.com.tr.

To dispute a prepaid card transaction, you must either contact our customer representatives or complete the transaction dispute form sent via harcamaitirazi@sipay.com.tr.

In accordance with international transaction dispute rules, all disputes must be submitted to us in writing through the transaction dispute form.

According to the rules of credit card institutions such as Visa, Mastercard, transaction objections must be made within a certain period of time.

While evaluating transaction objections, documents submitted by the counter bank or workplace are also examined. This review process varies between 60 and 180 days, according to Visa, Mastercard rules. At the end of this period, you will receive information about the result via e-mail regarding the expenditure objections.

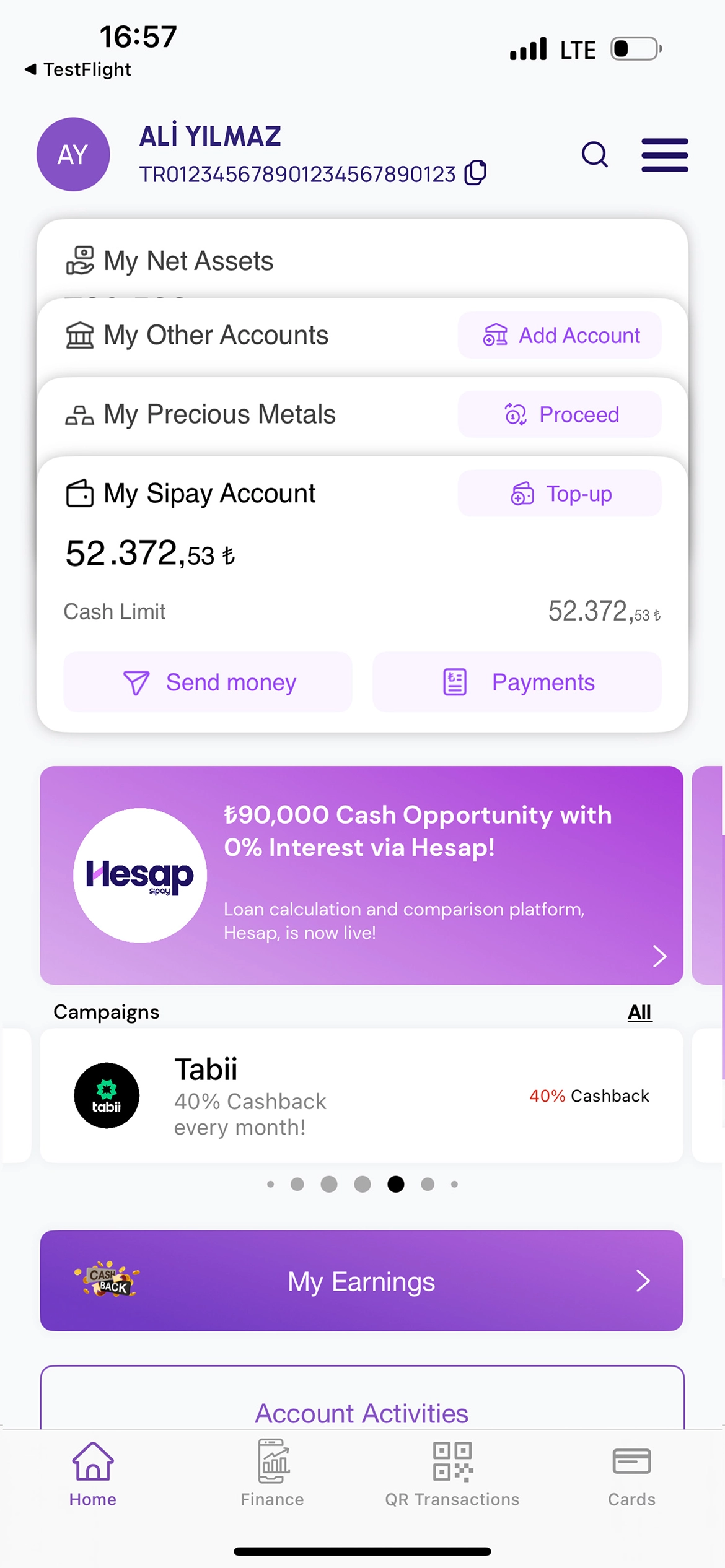

Note: Sipay prepaid card users can request the temporary or permanent deactivation of their prepaid cards due to potential suspicious transactions by calling our call center at 444 67 67 or by managing their transactions through the Sipay Wallet application.

Sipay Advantages

Discover the World of Sipay Now!

Download the Sipay application now and take your place in the advantageous world of Sipay!

Start benefiting from Sipay Wallet privileges right away.

Embark on a Journey with Our Team: Follow Us!

Follow our social media accounts to stay updated on our latest products, fun content, and team energy!

We'll be delighted to share with you.